An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Financial Statement Issues That Are Unique To Manufacturers

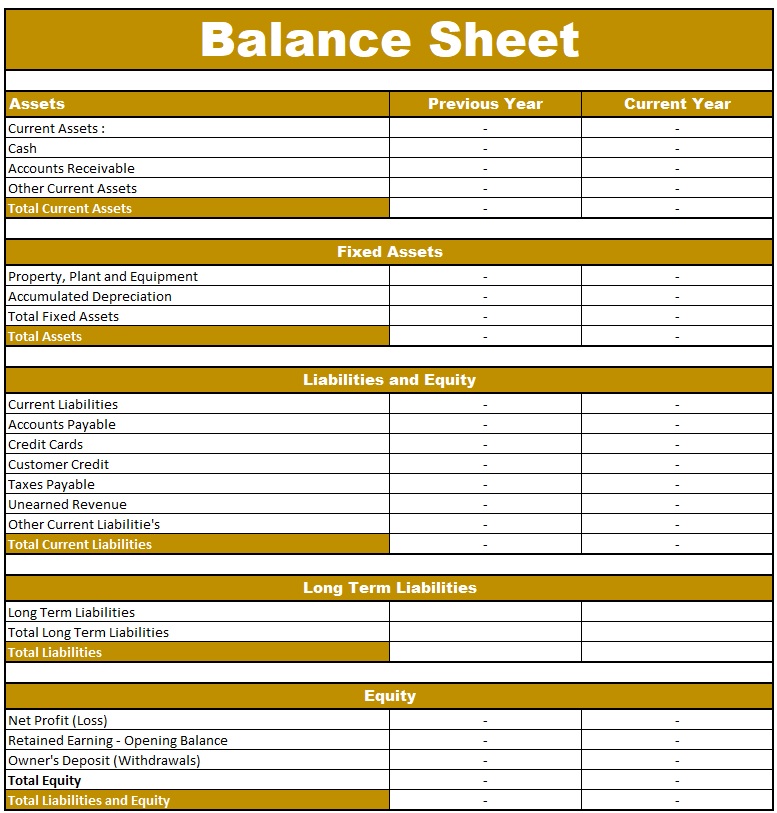

You can think of it like a snapshot of what the business looked like on that day in time. Accurate financial statements are essential for all manufacturing companies, as they play a critical role in managing the complex web of production processes. These businesses must track various components, including raw materials, work-in-progress inventory, equipment, and labor. Manufacturers divide assets into current, or short-term, fixed, or long-term, and other assets. For manufacturing firms, current assets typically include raw materials, work in process and finished goods, which all fall into the inventory category. Long-term assets include handling equipment such as forklifts and industrial pushcarts.

Great! The Financial Professional Will Get Back To You Soon.

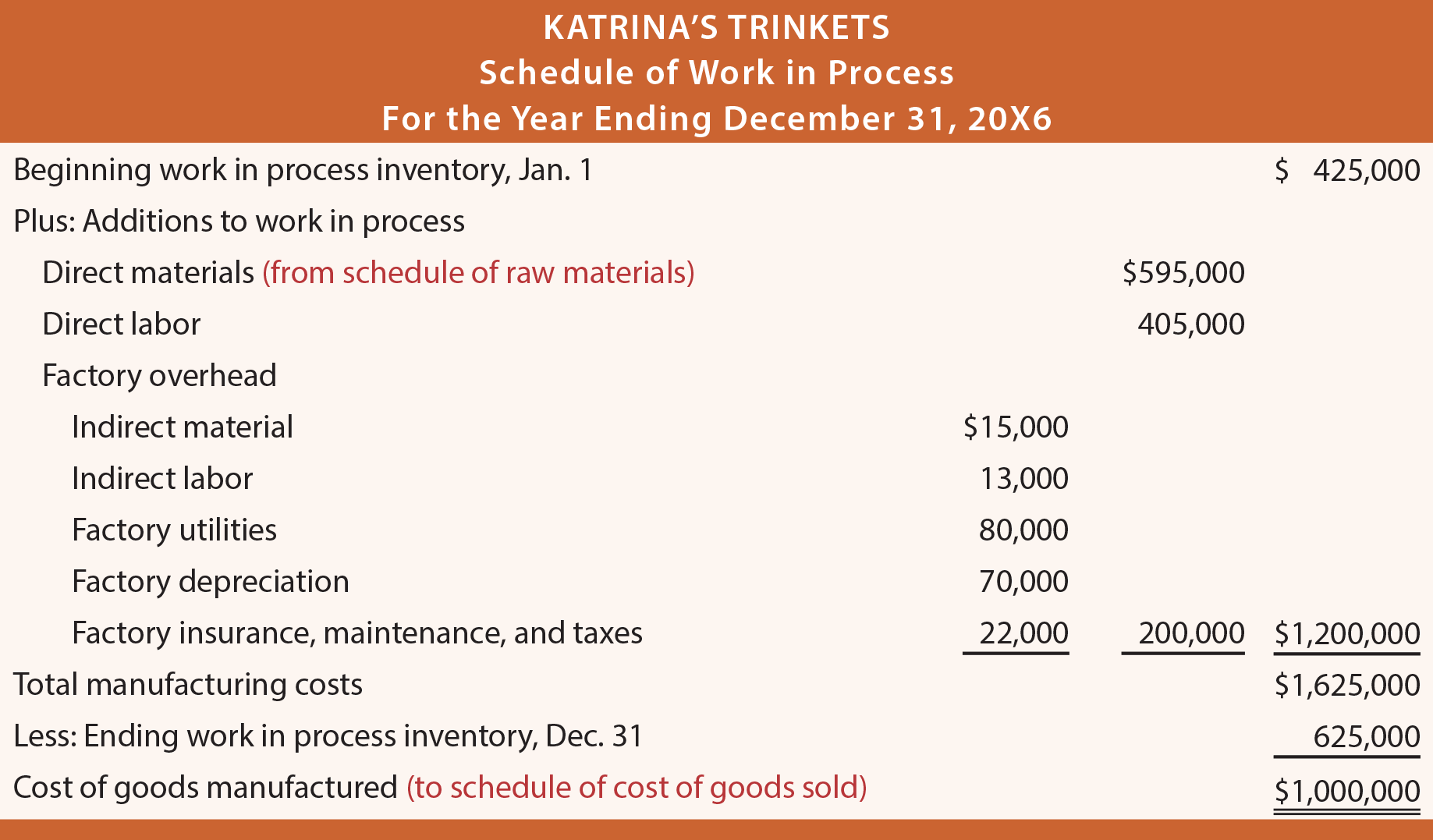

Typically, this entails a detailed set of calculations/schedule for each of the respective inventory categories. Don’t be intimidated by the number of schedules, as they are all based on the same concept. Current assets consist of resources that will be used in the current year, while long-term assets are resources lasting longer than one year. At the same time, crediting the profit and loss account by the amount of manufacturing profit does not affect the net profit. Goods are transferred to the trading account at a value which the business would have paid had these goods been bought from other manufacturers.

Improper Accounting for Work in Process (WIP)

Effective inventory management is vital for manufacturing firms, yet achieving accuracy can be challenging due to resource constraints. The complexity of tracking raw materials, work-in-progress, and finished goods often results in significant valuation errors. However, inaccuracies in these statements can lead to severe consequences, including flawed budgeting, mispriced inventory, and misguided operational strategies. To mitigate these risks, it is essential to understand and avoid common mistakes in financial reporting. These are the materials or components intended for use in finished products but are yet to be utilized in the manufacturing process.

- The National Law Review is not a law firm nor is intended to be a referral service for attorneys and/or other professionals.

- When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later.

- After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

The balance sheet is essentially a picture a company’s recourses, debts, and ownership on a given day. This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day. Most people understand that manufacturing financial statements provide an essential snapshot of a company’s financial health.

Types of Accounts Used for Small Business Accounting

The example above complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow. In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash). Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are. Without this knowledge, it can be challenging to understand the balance sheet and other financial documents that speak to a company’s health. When a balance sheet is reviewed externally by someone interested in a company, it’s designed to give insight into what resources are available to a business and how they were financed.

By understanding the financial implications of production decisions, companies can improve their overall efficiency and profitability. Consequently, this informed decision-making fosters a proactive approach to addressing market fluctuations and operational challenges. Direct labor costs are critical as they pertain to workers directly involved in production. Common mistakes include failing to capture all direct labor expenses or misallocating these costs. However, accurate financial reporting not only highlights areas of success but also identifies necessary adjustments, guiding manufacturers toward optimized performance.

Based on this information, potential investors can decide whether it would be wise to invest in a company. Similarly, it’s possible to leverage the information in a balance sheet to calculate important metrics, handr block, turbotax glitch may impact some stimulus checks from the irs such as liquidity, profitability, and debt-to-equity ratio. Mistakes in recording operating cash flow are common, especially regarding expenses related to raw material purchases and manufacturing costs.