In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. This is because the contribution margin ratio lets you know the proportion of statement of changes in equity profit that your business generates at a given level of output. Thus, the contribution margin ratio expresses the relationship between the change in your sales volume and profit.

How to Calculate Contribution per Unit

Such an analysis would help you to undertake better decisions regarding where and how to sell your products. A subcategory of fixed costs is overhead costs that are allocated in GAAP accounting to inventory and cost of goods sold. This allocation of fixed overhead isn’t done for internal analysis of contribution margin. To cover the company’s fixed cost, this portion of the revenue is available.

Does the Contribution Margin Calculation include Services Revenue?

For example, if the cost of raw materials for your business suddenly becomes pricey, then your input price will vary, and this modified input price will count as a variable cost. Contribution per unit is the residual profit left on the sale of one unit, after all variable expenses have been subtracted from the related revenue. This information is useful for determining the minimum possible price at which to sell a product. In essence, never go below a contribution per unit of zero; you would otherwise lose money with every sale.

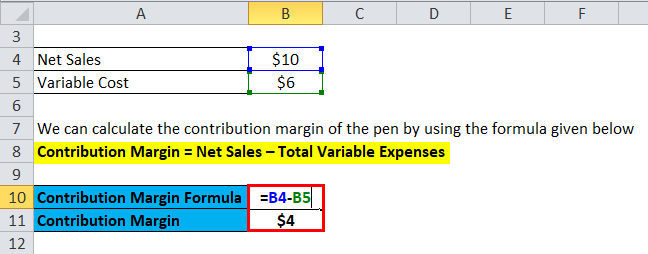

- The first step to calculate the contribution margin is to determine the net sales of your business.

- If the fixed costs have also been paid, the remaining revenue is profit.

- The contribution margin income statement separates the fixed and variables costs on the face of the income statement.

- Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs.

Create a Free Account and Ask Any Financial Question

Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit. For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40). This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit.

However, the contribution margin facilitates product-level margin analysis on a per-unit basis, contrary to analyzing profitability on a consolidated basis in which all products are grouped together. Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs. A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\).

How does the contribution margin affect profit?

Alternatively, the company can also try finding ways to improve revenues. For example, they can simply increase the price of their products. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources.

The higher a product’s contribution margin and contribution margin ratio, the more it adds to its overall profit. In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). In this example, if we had been given the fixed expenses, we could also find out the firm’s net profit.

Either way, this number will be reported at the top of the income statement. You need to work out the contribution margin per unit, the increase in profit if there is a one unit increase in sales. Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Calculations with given assumptions follow in the Examples of Contribution Margin section. Investors often look at contribution margin as part of financial analysis to evaluate the company’s health and velocity. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues.